News Release – Vancouver, British Columbia – December 22, 2021: New Placer Dome Gold Corp. (“New Placer Dome” or the “Company”) (TSX-V: NGLD) (OTC: NPDCF) (FSE: BM5) and Copaur Minerals (“Copaur Minerals”) (TSX-V: CPAU) are pleased to announce that a 1,700 metre diamond drill program has commenced at the Bolo gold-silver project (the “Bolo Project” or “Bolo”). New Placer Dome is also pleased to announce that the final share issuance pursuant to the Bolo earn in agreement has been made. The diamond drill program will focus on expansion of existing at surface, Carlin style, high-grade gold-silver oxide, mineralized zones.

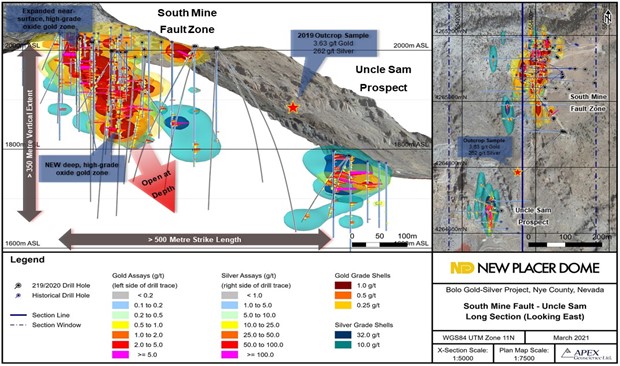

New Placer Dome has planned an initial 6 high-priority diamond drill holes at Bolo totaling approximately 1,700 m targeting the Mine Fault and other mineralized structures that host the South Mine Fault, Uncle Sam, and Northern Extension mineralized gold zones. The program is expected to significantly assist the development of a 3D geological model for the South Mine Fault Zone.

Jeremy Yasenuik and John Williamson of the Metals Group, Max Sali, CEO of New Placer Dome Gold Corp., on site at the Bolo Project – December 2021

Bolo diamond drill rig testing a priority target – December 2021

Drill core from drill hole BL21-01 showing mineralized, decalcified, silicified, and brecciated interpreted Windfall Formation within South Mine Fault Zone (̴ 579-599 ft.)

“Last week, our team and the Metals Group completed a site visit to Bolo where core drilling of initial priority holes and dirt works for future pads is already underway. Seeing Bolo in person again reminded us of the potential of this Carlin asset and both parties are very excited to work together on advancing this asset”, stated New Placer Dome’s CEO Maximilian Sali.

Copaur Mineral’s CEO Jeremy Yaseniuk commented, “Witnessing this asset for the first time, drives home why Nevada is such a world class jurisdiction to work in. The project is easily accessible by vehicle year-round and the mineralization is open to expansion. It will be exciting to explore its full potential. We look forward to completing the transaction with New Placer Dome.”

The 2021 program will in part expand and step-out on results from the successful 2019 and 2020 RC programs (see New Placer Dome news releases dated November 7, 2019, and February 1, 2021) including:

- 84 metres of 1.37 g/t gold in hole BL19-01[1], and

- 122 metres of 1.2 g/t gold; including an upper zone of 37 metres of 2.1 g/t Au and a new discovery lower zone of 12.2 metres of 3.32 g/t gold in hole BL19-041, and

- 24 metres of 1.38 g/t Au; including 6.1 metres of 4.35 g/t Au at surface in BL20-021, and

- 61 metres of 0.74 g/t Au in hole BL20-031, and

- 98 metres of 0.54 g/t Au in hole BL20-051, and

- 98 metres of 0.41 g/t Au in hole BL20-061

The combined 2019/2020 and historical RC drilling at Bolo defines a 1.2 kilometer north-south trending corridor of gold-silver mineralization containing the South Mine Fault Zone, Uncle Sam, and Northeast Extension zones. Gold mineralization at Bolo exhibits characteristics of classic Carlin-type mineralization, including strong subvertical structural control in addition to evidence of gold mineralization extending laterally at low angles within favorable silty carbonate units. The relatively untested 500 m strike length South Mine Fault-Uncle Sam segment is particularly prospective and is the continued focus of the 2021 drilling (Figure 1).

In conjunction with the diamond drill program, a program of expanded induced polarization (IP) resistivity geophysical surveys are now underway. The 2021 IP/resistivity surveys will extend geophysical coverage one (1) km northward to encompass the north extensions of the prospective Mine Fault and East Fault targets.

Surface sampling at Bolo has defined widespread gold mineralization, associated with jasperoids, iron-stained structures, and anomalous pathfinder elements including barium, mercury, arsenic, and antimony along two parallel north-south trending faults known as the Mine Fault and the East Fault. Alteration along the Mine Fault has been traced for 2,750 metres, with outcrop sampling returning gold values of 5.2 g/t gold (South Mine Fault Zone). The East Fault has been mapped for 2,200 metres and has returned gold values of 4.6 g/t gold (East Fault).

Figure 1: 2019/2020 Bolo Gold Project RC Drill Holes and Gold Targets

[1] The true width of mineralization is estimated to be approximately 60-70% of drill width.

Final Bolo Share Payment

On June 27, 2018, New Placer Dome entered into the Bolo option agreement (the “Bolo Agreement”) with Allegiant Gold Ltd., Allegiant Gold Holding Ltd. and Allegiant Gold (U.S.) Ltd. (“Allegiant”) pursuant to which New Placer Dome received the option to acquire up to a 75% interest in the Bolo Project located in Nye County, Nevada, USA. On December 17, 2021, New Placer Dome issued the final share payment to Allegiant consisting of USD$250,000 of common shares at a deemed price of $0.20 per share resulting in the issuance of an aggregate of 1,608,350 common shares, which are subject to a four month hold period. Pursuant to the terms of the Bolo Agreement, there remains certain property expenditures to be completed in the 2021 and 2022 calendar years in order for New Placer Dome to acquire an initial 50.01% interest in the Bolo Project.

TSXV Approval of Convertible Note

New Placer Dome is pleased to announce that, further to its news release dated December 13, 2021, it has received TSX Venture Exchange (the “Exchange”) approval and obtained a loan of US$840,000 (the “Loan”) by way of a convertible promissory note dated December 10, 2021, as amended December 20, 2021 (the “Convertible Note”) from Copaur Minerals, the proceeds of which will be used by New Placer Dome to fund its ongoing exploration work on the Bolo Project and to meet its 2021 work expenditure commitment on the property.

The Loan has a term of one year and will bear interest at an interest rate of 10% per annum calculated and compounded monthly. The Loan is convertible into units of New Placer Dome (“Units”) at Cdn$0.085 per Unit (the conversion price has been amended from $0.08 (as previously announced in New Placer Dome’s news release dated December 13, 2021) to $0.085 in accordance with the policies of the Exchange): (i) at the option of Copaur at any time on or subsequent to May 31, 2022 or earlier as a result of certain other events; or (ii) at the option of New Placer Dome on or subsequent to the maturity date of the Loan. Each Unit will consist of one common share of New Placer Dome and one common share purchase warrant with each warrant exercisable into one common share of New Placer Dome at a price of Cdn$0.12 per share for a period of 36 months. Copaur has the ability to accelerate repayment of the principal amount of the Loan in the event of the occurrence of certain customary default events.

The Convertible Note is subject to a four month and one-day restricted resale period expiring on April 11, 2022, in accordance with the policies of the TSX Venture Exchange and applicable securities law. All securities issuable under the terms of the Convertible Note will similarly be subject to a four month and one-day restricted resale period.

Proposed Transaction

As previously stated in a joint news release dated December 3, 2021, New Placer Dome and Copaur Minerals entered into a letter agreement dated November 30, 2021 pursuant to which Copaur Minerals will acquire all of the issued and outstanding common shares of New Placer Dome in an arm’s length transaction (the “Proposed Transaction”). The Proposed Transaction will be set out in mutually acceptable, negotiated, definitive transaction agreements including a definitive agreement (the “Definitive Agreement”) between New Placer Dome and Copaur Minerals. The Definitive Agreement will include customary provisions for transaction of this nature including representations and warranties, covenants, deal protections and conditions to closing, including fiduciary-out provisions, covenants not to solicit other acquisition proposals and the right to match any superior proposal and a termination fee as a result of New Placer Dome accepting a superior proposal or completing an alternative proposal within 12 months of termination of the Transaction.

The Proposed Transaction will be effected by way of a court approved Plan of Arrangement to be completed under the British Columbia Business Corporations Act. The Proposed Transaction will require the approval of (i) at least 66 2/3% of the votes cast by the shareholders of New Placer Dome and (ii) at least 66 2/3% of the votes cast by the shareholders of New Placer Dome and the holders of options and warrants, voting together as a single class, at a special meeting of New Placer Dome securityholders that will be called to consider the Proposed Transaction. New Placer Dome’s outstanding options and warrants will be exchanged for Copaur Minerals options and warrants and adjusted in accordance with their terms such that the number of Copaur Minerals shares received upon exercise and the exercise price will reflect the consideration described above.

Upon completion of the Proposed Transaction, New Placer Dome’s shares will be de-listed from the TSX Venture Exchange and it is expected that Copaur Minerals will apply to cause New Placer Dome to cease being a reporting issuer under applicable Canadian securities laws. Upon execution of the Definitive Agreement, the full details of the Proposed Transaction will be included in the management information circular to be filed with regulatory authorities and mailed to New Placer Dome shareholders in accordance with applicable securities laws

About New Placer Dome Gold Corp.

New Placer Dome Gold Corp. is a gold exploration company focused on acquiring and advancing gold projects in Nevada. New Placer Dome’s flagship Kinsley Mountain Gold Project, located 90 km south of the Long Canyon Mine (currently in production under the Newmont/Barrick Joint Venture), hosts Carlin-style gold mineralization, previous run of mine heap leach production, and NI 43-101 indicated resources containing 418,000 ounces of gold grading 2.63 g/t Au (4.95 million tonnes) and inferred resources containing 117,000 ounces of gold averaging 1.51 g/t Au (2.44 million tonnes)[1]. The Bolo Project, located 90 km northeast of Tonopah, Nevada, is another core asset, similarly hosting Carlin-style gold mineralization. New Placer Dome also owns 100% of the Troy Canyon Project, located 120 km south of Ely, Nevada. New Placer Dome is run by a strong management and technical team consisting of capital market and mining professionals with the goal of maximizing value for shareholders through new mineral discoveries, committed long-term partnerships, and the advancement of exploration projects in geopolitically favorable jurisdictions.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, a Director of New Placer Dome Corp., and a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Raffle verified the data disclosed which includes a review of the analytical and test data underlying the information and opinions contained therein.

[1] Technical Report on the Kinsley Project, Elko County, Nevada, U.S.A., dated June 21, 2021, with an effective date of May 5, 2021, and prepared by Michael M. Gustin, Ph.D., and Gary L. Simmons, MMSA and filed under New Placer Dome Gold Corp.’s Issuer Profile on SEDAR (www.sedar.com).

On behalf of the Board of Directors,

Max Sali, Chief Executive Officer

New Placer Dome Gold Corp

Contact Information:

Max Sali, CEO & Director

Tel: (604) 620-8406

Email: info@newplacerdome.com

Jeremy Yaseniuk CEO Copaur Minerals Inc.

Tel: (604) 773-1467

Email: jeremyy@copaur.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this news release, referred to herein as “forward-looking statements”, constitute “forward-looking statements” under the provisions of Canadian provincial securities laws. These statements can be identified by the use of words such as “expected”, “may”, “will” or similar terms. Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by Copaur Minerals and New Placer Dome as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies.

Forward-looking statements in this press release relate to, among other things: the completion of the drilling and geophysical surveys on the Bolo Project; the timing and receipt of required shareholder, court, stock exchange and regulatory approvals for the Proposed Transaction; the ability of Copaur Minerals and New Placer Dome to satisfy the conditions to, and to negotiate and execute a definitive agreement and to complete, the Proposed Transaction; the anticipated timing for executing a definitive agreement; the anticipated timing of the mailing of the information circular regarding the Proposed Transaction; and the timing for closing of the Proposed Transaction. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: satisfaction or waiver of all applicable conditions to closing of the Transaction including, without limitation, receipt of all necessary securityholder, court, stock exchange and regulatory approvals or consents, completion of the concurrent financing and lack of material changes with respect to the parties and their respective businesses; the synergies expected from the Transaction not being realized; business integration risks; fluctuations in general macro-economic conditions; that New Placer Dome may lose or abandon its property interests or may fail to receive necessary licences and permits; the loss of key directors, employees, advisors or contractors; fluctuations in securities markets and the market price of Copaur Minerals’ and New Placer Dome’s shares; fluctuations in the spot and forward price of gold, silver, base metals or certain other commodities; fluctuations in the currency markets (such as the Canadian dollar versus the U.S. dollar); changes in national and local government, legislation, taxation, controls, regulations and political or economic developments; the impact of Covid-19 or other viruses and diseases on the ability to operate; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins and flooding); risks and uncertainties relating to the interpretation of exploration result; inability to obtain adequate insurance to cover risks and hazards; and the presence of laws and regulations that may impose restrictions on mining; adverse weather or climate events; increase in costs; equipment failures; litigation; competition; employee relations; relationships with and claims by local communities and indigenous populations; availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development, including the risks of obtaining necessary licenses, permits and approvals from government authorities; title to properties; the failure to meet the closing conditions thereunder and the failure by counterparties to such agreements to comply with their obligations thereunder. In addition, New Placer Dome may in certain circumstances be required to pay a non-completion or other fee to Copaur Minerals, the result of which could have a material adverse effect on New Placer Dome’s financial position and results of operations and its ability to fund growth prospects and current operations. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these times. Many factors, known and unknown, could cause actual results to be materially different from those expressed or implied by such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. Except as otherwise required by law, Copaur Minerals and New Placer Dome expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change in Copaur Minerals or New Placer Dome’s expectations or any change in events, conditions or circumstances on which any such statement is based.