Vancouver, British Columbia – June 6, 2022: CopAur Minerals Inc. (“CopAur” or the “Company”) (TSX-V: CPAU) (OTCQB:COPAF) is pleased to provide a corporate update following the successful acquisition of New Placer Dome Gold Corp.’s Nevada gold assets and exercising its option to acquire 79.99% of the flagship Kinsley Mountain Gold Project. The update provides a 2022 exploration plan and details on the company’s newly acquired Kinsley Mountain, Bolo and Troy projects in addition to its Williams Copper-Gold Project in northern British Columbia.

Jeremy Yaseniuk, CEO, commented, “Management is delighted to have completed the acquisition of New Placer Dome and its three highly prospective Nevada assets. Kinsley is of particular interest, sharing many characteristics with the nearby Long Canyon Mine. The 2009 Long Canyon maiden resource had over 50,000 fewer indicated ounces gold1 than the current Kinsley resource which includes 418,000 indicated ounces2, with both resources based on a similar number of drill holes. At the time of the $2.3 billion sale of Long Canyon in 2011, the resources had grown to 2.2 million ounces gold based on over 130,000 metres of drilling3, over 50% more than modern drilling at Kinsley showing the potential upside of the project4.”

Kinsley Mountain Gold Project, Nevada

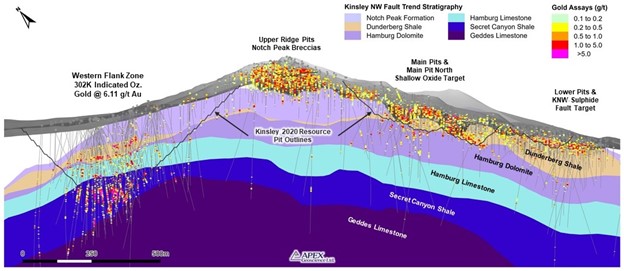

The Company’s flagship Kinsley Mountain Gold Project has current indicated resources of 418,000 oz at a grade of 2.63 grams per tonne (g/t) gold and inferred resources of 117,000 oz averaging 1.51 g/t gold2 (Figure 1). Of the indicated resources, 302,000 oz are found within the high-grade Western Flank Zone, with an average gold grade of 6.11 grams per tonne2. Historical open-pit mining at Kinsley produced 138,000 ounces of gold between 1995 and 1999. Kinsley Mountain shares the same unique combination of stratigraphy, structure and mineralization with the Long Canyon Mine4, located approximately 90 kilometres northwest. As of December 31, 2021, Long Canyon hosts a 1.38 million oz gold measured and indicated resource and has produced over 1 million oz gold4,5.

Kinsley has significant resource expansion potential through continued near mine exploration and potential greenfield discoveries. Near resource areas drilled during the highly successful 49 hole, 18,000 metre 2020 drill campaign demonstrate significant resource expansion potential remains at Western Flank, Main Pit Oxide, and Secret Spot targets with highlights including6:

Western Flank resource expansion drilling

- 10.22 g/t gold over 6.1 metres within a broader zone grading 2.63 g/t gold (sulphide) over 38.10 metres in KMR20-017

- 15.1 g/t gold (sulphide) over 7.6 metres, including 24.1 g/t gold (sulphide) over 4.6 metres lower zone, 9.08 g/t gold (sulphide) over 6.1 metres upper zone in KMR20-026

Main Pit North Oxide Target yields high-grade intercepts 75 m outside the current pit shell

- 9.83 g/t gold over 7.6 metres high-grade shallow oxide

New surface oxide Discovery at the Secret Spot, including

- 1.77 g/t gold over 25.3 metres in new surface oxide discovery in KMD20-007B

The Company is currently analyzing results from the recently completed 80 line-km IP/resistivity geophysical surveys completed at Kinsley. The surveys covered the Western Flank Zone, Secret Spot and Shale Saddle targets, as well as the Kinsley North Range to refine existing targets and generate new drill targets. The frontier Kinsley North Range contains a significant strike length of Pogonip Group and upper Notch Peak Formation rocks that are known to host significant gold mineralization at Long Canyon4. This area of the project remains untested by drilling until now.

Figure 1: Kinsley Mountain Gold Project Mine Fault area cross section

Bolo Gold Project, Nevada

The Bolo Gold Project is located in the Hot Creek Range of Nye County, Nevada, approximately 65 kilometres east-southeast of the Round Mountain Gold Mine4.

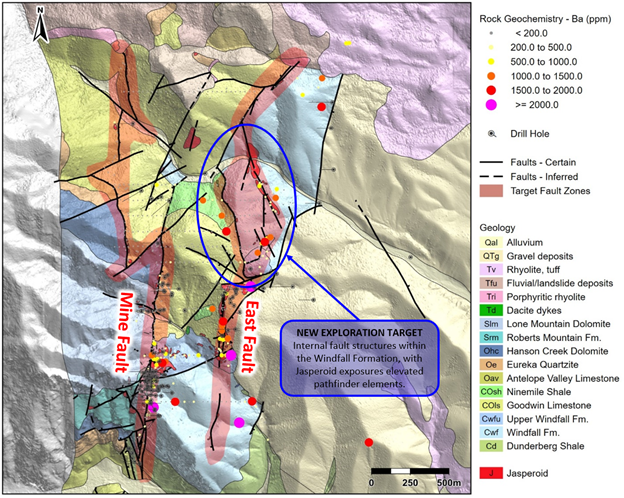

Bolo demonstrates significant near-term resource and discovery potential. Surface geochemical sampling has defined widespread gold mineralization, associated with jasperoids, iron-stained structures, and anomalous gold pathfinder elements along two parallel north-south trending faults known as the Mine Fault and the East Fault. IP/resistivity surveys completed during late 2021 expanded geophysical coverage 1 km north along the Mine Fault and East Fault targets (Figure 2). Successful drill campaigns in 2019 and 2020 were focused on the South Mine Fault Zone’s resource potential with highlights including6:

- 84 metres of 1.37 g/t gold oxide in hole BL19-01

- 122 metres of 1.2 g/t gold oxide; including an upper zone of 37 metres of 2.1 g/t gold oxide and lower zone of 12.2 metres of 3.32 g/t gold oxide in hole BL19-04

- 24 metres of 1.38 g/t gold oxide; including 6.1 metres of 4.35 g/t gold oxide in BL20-02

- 61 metres of 0.74 g/t gold oxide in hole BL20-03

- 98 metres of 0.54 g/t gold oxide in hole BL20-05

- 98 metres of 0.41 g/t gold oxide in hole BL20-06

In early 2022, New Placer Dome announced an untested high priority exploration target along the East Fault hosted within an outlier of the Windfall Formation, the primary host of gold mineralization at the South Mine Fault Zone (see New Placer Dome Gold Corp. news release dated January 24, 2022). Along the East Fault, Windfall outlier rocks are cut by fault-controlled jasperoid units and have returned gold pathfinder anomalies within gridded surficial rock samples. The favourable geology, structure, and pathfinder element anomalies highlighted in the East Fault area provide a compelling exploration target worthy of significant follow-up work and drilling.

Bolo – US $1.5M Proposed Work Program

- Surface prospecting and grid rock chip geochemical sampling targeting the northern extensions of the Mine Fault and East Fault structures (approximately 500 samples, extending historical rock chip coverage 1 km north and 300 m east-west).

- Up to 4,000 metres of RC and core drilling, including expansion drilling at the South Mine Fault Zone (1,000 m), as well as exploration drilling at the East Fault Windfall target and potential new targets generated by the surface work (3,000 m).

Figure 2: Bolo Gold Project plan map highlighting the Mine Fault zone and the new East Fault exploration target

Williams Copper-Gold Project, British Columbia

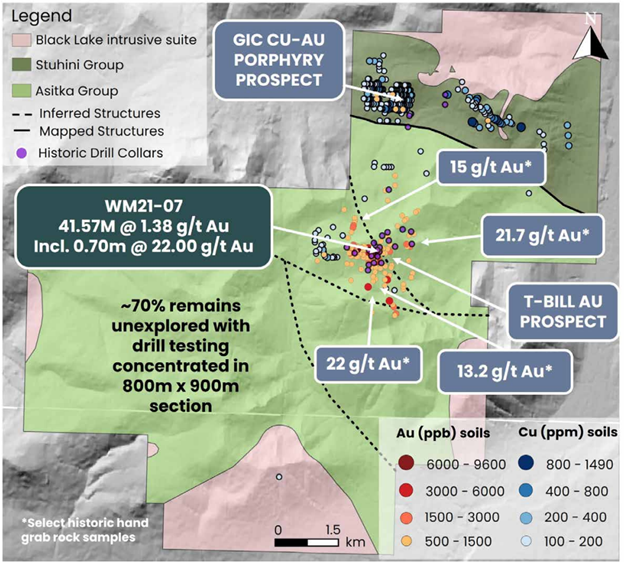

The Williams Copper-Gold Project is located in the Toodoggone region of north-central British Columbia. The property is situated halfway between the Red Chris and Kemess North mines, and on trend with the approximately 3-million-ounce Lawyers Gold-silver deposit4,7. Williams hosts two target areas: The T-Bill area, which is prospective for mesothermal style gold mineralization, the GIC porphyry prospect which is a porphyry copper-gold target.

During 2021 CopAur drilled 7 diamond drill holes totaling 3,150 metres targeting the T-Bill gold zone that included bulk-tonnage and high-grade mineralization including 41.57 metres of 1.38 g/t gold with 0.70 metres of 22.00 g/t gold in drill hole WM21-07 (Figure 3). Surface exploration targeting T-Bill and GIC included 158 rock and 654 soil geochemical samples, 25 line-km of IP/resistivity geophysical surveys covering the GIC porphyry copper-gold targets and its eastern extension, and a 718 line-km property-wide airborne VTEM geophysical survey.

Williams – CA $1.5M Proposed Work Program

- Up to 2,000 metres of core drilling testing the high priority GIC and T-Bill targets

For 2022 CopAur plans to complete up to 2,000 metres of diamond drilling testing priority drill targets at the GIC copper-gold porphyry target, a 4 km x 0.8 km copper-gold geochemical and IP/resistivity anomaly, and the T-Bill gold zone along its northern and southern strike extent.

Limited historical drilling of 5 holes totaling 881 metres during the 2006 exploration campaign at the GIC zone targeted chargeability high anomalies interpreted as part of a phyllic-pyritic halo related to a potential buried porphyry system. This drilling intersected broad zones of phyllic alteration, and patchy potassic zones returning anomalous copper mineralization within the chargeability high anomaly. However, peak copper-gold geochemical anomalies associated with magnetic and resistive anomalies flanking the high changeability remain untested and will be the target of the initial drilling during 2022.

Figure 3. Williams Copper-Gold Project GIC and T-Bill Exploration Targets

Troy Canyon Gold-Silver Project, Nevada

The Troy Canyon Gold-Silver Project is located in the Grant Range of Nye County, Nevada, approximately 150 km east-northeast of Tonopah and 70 km east-southeast of the Company’s Bolo Gold Project. The 100% owned Troy Canyon Project covers 493 hectares of land centered approximately on the historical Locke gold mine (Figure 4). High-grade gold mineralization occurs within mesothermal quartz veins, vein breccias and narrower sheeted vein and stockwork zones that are exposed at surface over 300 m strike length.

Gold mineralization was first identified at the project in 1867 and small-scale mining commenced in 1869. The most recent mining took place from 1948 to 1950 where 643 ounces of gold and 660 ounces of silver were reportedly produced from 1,859 tons of mineralized rock, at an average grade of 11.83 g/t gold (0.345 oz/t Au) and 12 g/t silver (0.355 oz/t Ag). The area of the old Locke mine in Troy Canyon hosts mesothermal gold and silver mineralization with potential for economically significant concentrations. Mesothermal systems typically are persistent to great depths. To date the system seen on the Troy Canyon Project has only been investigated over a vertical extent of approximately 180 metres.

In 2020, New Placer Dome conducted rock sampling at Troy to independently verify historical gold and silver values, which had previously reported underground stope rock grab samples assaying 576 g/t gold and greater than 100 g/t silver8. Highlights of the 2020 rock sampling included (see New Placer Dome Gold Corp. news release dated October 22, 2020):

- 7 g/t gold, 15 g/t gold, and 91 g/t silver in outcrop of partially oxidized silica-sulphide breccia at the historic Locke West and East mine prospects.

- 7 g/t gold in oxidized quartz vein material sampled from historic waste dumps at the Locke East mine.

- 68 g/t gold including 526 g/t silver, in addition to 97.20 g/t silver and 105 g/t silver from mine dump material coincident with a 1.2 km north-south trending greater than 10 ppb gold in soil anomaly along the western Troy Canyon Claims along the historic Leadhill and Galena vein trends.

Figure 4. Historical Locke gold mine looking north

1Technical Report on the Long Canyon Project, Elko County, Nevada, U.S.A., dated April 24, 2009, with an effective date of April 17, 2009, and prepared by Michael M. Gustin and Moira Smith, and filed under Fronteer Gold Inc.’s issuer profile on SEDAR (www.sedar.com).

2Technical Report on the Kinsley Project, Elko County, Nevada, U.S.A., dated June 21, 2021, with an effective date of May 5, 2021, and prepared by Michael M. Gustin and Gary L. Simmons, and filed under New Placer Dome Gold Corp.’s issuer profile on SEDAR (www.sedar.com).

3Updated Technical Report on the Long Canyon Project, Elko County, Nevada, U.S.A., dated February 25, 2011, with an effective date of December 15, 2010, and prepared by Moira Smith, James Gray, Christopher Lee, and Gary Simmons, and filed under Fronteer Gold Inc.’s issuer profile on SEDAR (www.sedar.com).

4Minerals resource or reserves of advanced projects are not necessarily indicative of the mineralization potential of CopAur Properties.

5Resource and 2021 production values derived from Barrick Annual Report 2021 filed under Barrick Gold Corporation’s issuer profile on SEDAR (www.sedar.com); 2016 to 2020 production values derived from the Nevada Division of Minerals Major Mines of Nevada 2016-2020 publications downloaded from the State of Nevada Commission on Mineral Resources Division of Minerals website (https://minerals.nv.gov/Programs/Mining/Mining_Forms/)

6True widths of the mineralized intervals are interpreted to be between 60-90% of the reported lengths for Kinsley and 60-70% for Bolo.

7Technical Report and Updated Mineral Resource Estimate on the Lawyers Gold-Silver Property, Omineca Mining Division, British Columbia, Canada, ated June 28, 2021, with an effective date of May 11, 2021, and prepared by William Stone, Yungang Wu, Jarita Barry, Eugene Puritch, Brian Ray, Frank Wright, and Mary Mioska, and filed under Benchmark Metals Inc.’s issuer profile on SEDAR (www.sedar.com).

8National Instrument 43-101 Technical Report on the Troy Canyon Project, Portage Minerals Inc., with an effective date of February 5, 2007 prepared by Jim Chapman, and filed under Portage Minerals Inc.’s issuer profile on SEDAR (www.sedar.com).

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, a Director of New Placer Dome and a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Raffle has verified the data disclosed which includes a review of the sampling, analytical and test data underlying the information and opinions contained herein.

For more information, please contact:

CopAur Minerals Inc.

Jeremy Yaseniuk, Chief Executive Officer & Director

Tel: +1 (604) 773-1467

Email: jeremyy@copaur.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward Looking Information

This news release includes certain statements that constitute “forward-looking information or statements” within the meaning of applicable securities law, including without limitation, conducting exploration work on its projects, receipt of assays, other statements relating to the technical, financial and business prospects of the Company and its properties, and other matters.

Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved), and variations of such words, and similar expressions are not statements of historical fact and may be forward-looking statements. Forward-looking statement are necessarily based upon a number of factors that, if untrue, could cause the actual results, performances or achievements of the Company to be materially different from future results, performances or achievements express or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of metals, anticipated costs and the ability to achieve goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks.

Forward-looking statements are subject to a variety of risks and uncertainties, which could cause actual events, level of activity, performance or results to differ materially from those reflected in the forward-looking statements, including, without limitation: (i) risks related to gold and other commodity price fluctuations; (ii) risks and uncertainties relating to the interpretation of exploration results; (iii) risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses; (iv) that resource exploration and development is a speculative business; (v) that the Company may lose or abandon its property interests or may fail to receive necessary licences and permits; (vi) that environmental laws and regulations may become more onerous; (vii) that the Company may not be able to raise additional funds when necessary; (viii) the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; (ix) exploration and development risks, including risks related to accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration and development; (x) competition; (xi) the potential for delays in exploration or development activities or the completion of geologic reports or studies; (xii) the uncertainty of profitability based upon the Company’s history of losses; (xiii) risks related to environmental regulation and liability; (xiv) risks associated with failure to maintain community acceptance, agreements and permissions (generally referred to as “social licence”); (xv) risks relating to obtaining and maintaining all necessary government permits, approvals and authorizations relating to the continued exploration and development of the Company’s projects; (xvi) risks related to the outcome of legal actions; (xvii) political and regulatory risks associated with mining and exploration; (xix) risks related to current global financial conditions; and (xx) other risks and uncertainties related to the Company’s prospects, properties and business strategy. These risks, as well as others, could cause actual results and events to vary significantly.

Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, the loss of key directors, employees, advisors or consultants, adverse weather conditions, increase in costs, equipment failures, government regulations and policies, litigation, exchange rate fluctuations, the impact of Covid-19 or other viruses and diseases on the Company’s ability to operate, decrease in the price of gold and other metals, failure of counterparties to perform their contractual obligations and fees charged by service providers. Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The forward-looking statements included in this news release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation.